Most of us think about accidents only when deciding whether to pursue coverage. Did you know that less than 20% of our claims come from accidents? Let’s look at the typical lifetime of a cat to see how pet insurance helps pet families keep their furry friends happy and healthy.

Meet Oliver the kitten

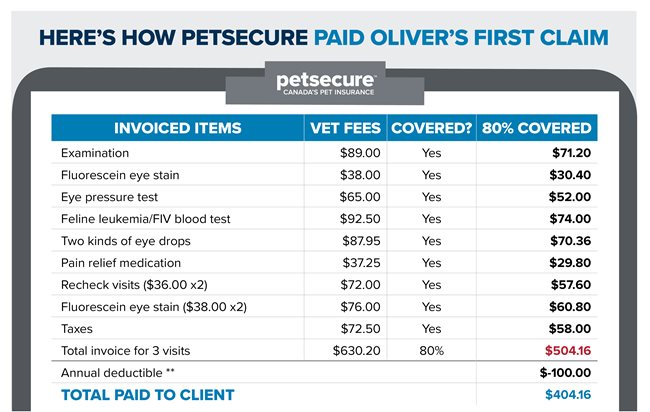

Oliver was a very busy kitten. Even though his family removed all potentially toxic plants before he came home, he was very interested in the living room cactus. His owners noticed him squinting his left eye. He was taken to the veterinary clinic three times to treat the corneal ulcer and eye infection.

All fees related to the cost of the examination, eye testing, virus testing, treatment, and taxes are eligible for coverage. This claim was the first in the policy year, and so the annual deductible was applied. No further deductible is applied in subsequent claims during this policy year**

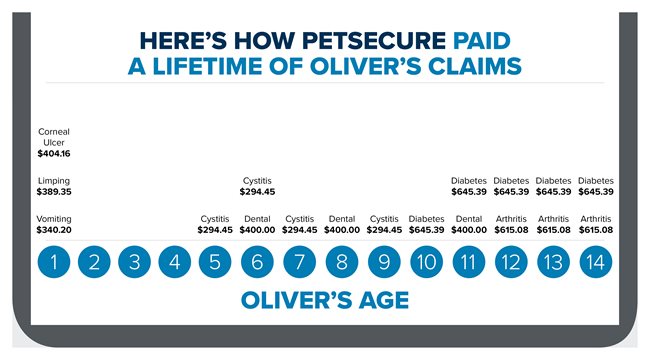

Oliver had 2 additional vet visits during his first year:

- Developed a limp after jumping off the refrigerator. Vet costs for exam, x-rays, splint, and pain medications: $468.69. Petsecure paid 80% $389.35.

- Experienced vomiting and diarrhea after the family changed his diet. Vet costs for exam, fecal check, blood testing, and treatment: $ 425.25. Petsecure paid 80%: $340.20.

Total claims paid during his first year: $1133.71.

Oliver turns five

When Oliver was five, he started urinating outside his litter box and was diagnosed with interstitial cystitis – a painful condition of the bladder.

Over the next few years, Oliver visited the vet multiple times.

- Costs related to urinary condition for exams, urine testing, and medications. Vet costs: $401.29 Petsecure paid 80% after annual deductible of $300: $294.45.

- Diagnosed with feline oral resorptive lesions. The dental costs included anaesthesia, dental cleaning, full-mouth x-rays, and two extractions with each procedure. Vet costs: $678.34. Petsecure annual dental benefit on the Secure 3 plan: $400.00.

Total claims paid during this period: $1977.80.

Oliver turns ten

Oliver had lost weight over the last year and become very thirsty. During blood testing for another dental procedure, he was diagnosed with diabetes mellitus and treated with long-term insulin injections. He developed arthritis in his front legs when he was twelve.

- Annual diabetes management included examinations, blood and urine testing, insulin prescription and needles, as well as purchase of glucometer for home testing: Vet costs: $1431.73. Petsecure paid 80% after annual deductible of $500.00: $645.39.

- Once his diabetes was stabilized, he was okay to be anaesthetized for his dental procedure. Vet costs: $678.34. Petsecure annual dental benefit on the Secure 3 plan: $400.00

- Treated for arthritis with pain relief medication. Vet costs: $768.85. Petsecure paid $615.08.

Total claims paid during this period: $5472.19.

Oliver’s lifetime

At 14 years-old, Oliver’s family still had peace of mind that their beloved pet’s health would be covered with Petsecure. Even though, they did not claim every year, the total claims paid over Oliver’s lifetime to date have amounted to $8583.70.

*Oliver’s story is based on a composite Petsecure pet covered under a Secure 3 Deductible A Plan experiencing common medical conditions for a domestic shorthair cat. Claim payments were calculated using Canadian veterinary fees in Canadian dollars.

Learn what’s covered by Petsecure and get a free quote today.